Invest in VanWest Storage Fund III, a diversified, self storage fund with an institutional quality sponsor.

VanWest seeks to provide stable cash flow through an asset class that has historically outperformed other property types in periods of economic uncertainty and high inflation.

Save Your SpotOffering Overview

VanWest Self Storage Fund III

The Opportunity

EquityMultiple is bringing you a unique private fund opportunity in one of the most potentially counter-cyclical asset classes. The VanWest Storage Fund has consistently delivered quarterly distributions of 8% annualized since inception. The Fund targets value-add and income producing self storage facilities, generating returns through active management and revenue/expense optimization.

Experience Sponsor, Expert Fund Management

The Sponsor uses their proprietary software to assist in the acquisition of new assets, with data covering over 27K facilities and over 73M historic data points.

The Fund’s management affiliate leverages an advanced suite of technology to convert inefficiently managed facilities into assets that drive revenue, capture ancillary income, reduce delinquencies, and efficiently manage expenses in order to increase net operating income.

‣ EquityMultiple investors will have the benefit of acquiring the Fund’s “Class A Units”, which provides the lowest carried interest split earned by the Sponsor of 20%.

‣ Class A units have an approximate 1.0% higher yield to IRR over Class C units (30% manager carried interest split).

‣ Self storage’s short-term leased nature provides a natural inflation hedge to investors.

‣ Historically, the property type has also weathered economic downturns well, with notable resilience shown during the Great Financial Crisis.

‣ Between 1994-2018, self storage REITs had the best risk-adjusted return across all asset classes, as denoted by the Sharpe ratio of 0.78 (a measure of return per unit of risk), driven by the asset class’ second lowest volatility and highest average annual return across eight sectors, as covered by NAREIT.

‣ Due to the sector’s sticky tenant base, institutionally managed assets have consistently seen occupancy levels over 90% since 2014. Peaking in the Pandemic at 95.9%, occupancy is forecasted to reach 93.3% by 2026, remaining above pre-Pandemic levels.

‣ Self storage remains a fragmented industry with over 74% of facilities owned by small operators.

‣ The fragmentation of the market creates a unique opportunity for the Sponsor to target off-market assets, at a discount to broadly marketed properties.

‣ Since the firm’s inception, the Sponsor has sourced more than two thirds of their acquisitions off-market, driven by their proprietary software and institutional approach.

Get Started

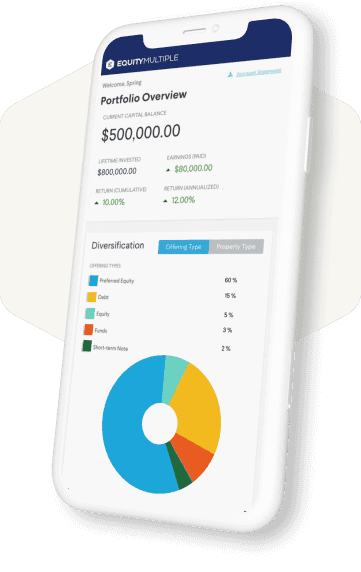

Start building a more diversified portfolio today